The world of blockchain gaming is buzzing once again, and at the center of the noise is SLP—Smooth Love Potion—the native utility token of the Axie Infinity ecosystem. After a prolonged downturn following the 2021–2022 boom, SLP is showing renewed signs of life in 2025, prompting investors and players alike to ask: Is this the return of the Play-to-Earn (P2E) model?

With a more mature ecosystem, strategic updates from Sky Mavis, and rising crypto adoption globally, SLP’s resurgence could be more than a temporary spike—it might just signal a second act for the Play-to-Earn revolution.

What Is SLP?

SLP, or Smooth Love Potion, is an ERC-20 token that players earn by participating in Axie Infinity, one of the earliest and most successful blockchain games. Originally used to breed Axies (digital creatures in the game), SLP has become symbolic of the P2E economy, where players earn real value through gameplay.

SLP was once hailed as a model for how blockchain could disrupt both gaming and income generation. At its peak in mid-2021, it reached nearly $0.36 USD per token, with some players earning hundreds of dollars per month.

The Rise, Fall, and Now Rise Again

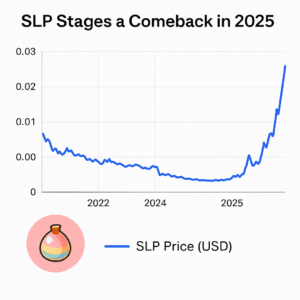

After its explosive growth, SLP experienced a dramatic decline due to oversupply, economic imbalance, and market fatigue. By early 2023, the token had dropped below $0.01, and many critics pronounced the P2E model “dead.”

But in Q1 2025, something changed.

Key Signs of SLP’s Comeback:

-

SLP surged over 80% between January and April 2025, hovering around $0.018.

-

Daily active users on Axie Infinity rose from 110,000 to 300,000 in just 3 months.

-

Sky Mavis rolled out new burn mechanisms, including in-game upgrades, events, and dynamic breeding fees to reduce inflation.

-

Integration of SLP into side projects and partner ecosystems, adding real-world use cases.

“We’ve learned from the mistakes of the past. This isn’t about hype—it’s about building sustainable digital economies,” said Trung Nguyen, CEO of Sky Mavis, in a March 2025 interview.

What’s Fueling SLP’s Return?

1. Improved Game Economy

Sky Mavis has rebalanced SLP’s mint and burn rates, introducing seasonal rewards, leaderboard incentives, and more strategic uses for the token within the game.

The goal: Create consistent demand for SLP rather than relying on speculative trading.

In the past, players could flood the market with SLP, creating massive inflation. Now, breeding caps and energy limits control supply without discouraging activity.

2. Better Player Retention and Experience

New gameplay features—such as Axie Origins, Axie Homeland, and crafting mechanics—have diversified how players engage, making it less repetitive and more rewarding.

This has attracted returning players and new audiences, leading to increased SLP usage across multiple layers of gameplay.

3. Broader Web3 Ecosystem Integration

SLP is no longer confined to Axie Infinity. Sky Mavis has announced that partner games and dApps can adopt SLP as a utility token through the Ronin blockchain.

This kind of cross-game utility is a game-changer, allowing SLP to evolve from a single-game asset to a multi-platform currency.

Is the Play-to-Earn Era Really Coming Back?

Not quite like before—but possibly in a more sustainable form.

The Old P2E Model:

-

Play more = earn more

-

Focus on token farming

-

High inflation, unsustainable returns

The New P2E Model (2025):

-

Play smarter = earn through skill, rarity, events

-

Token sinks balance economy

-

Emphasis on ownership, crafting, and community

This shift turns P2E into what some are calling “Play-and-Earn” or “Play-and-Own”, focusing less on profit-maximizing and more on value creation.

“We’re not going back to the gold rush days. But we’re entering an era where Web3 gaming will actually be fun—and that’s where SLP fits in,” said Yield Guild Games co-founder Gabby Dizon at the 2025 GameFi Asia Summit.

Should You Invest in SLP in 2025?

✅ Reasons to Consider:

-

Strong infrastructure: Ronin sidechain is fast, cheap, and secure.

-

User growth: More daily players means higher token utility.

-

Broader adoption: SLP may soon be used outside of gaming.

❌ Risks to Keep in Mind:

-

Volatility: SLP remains highly reactive to game updates and sentiment.

-

Regulatory uncertainty: Some governments may target token-based earnings as taxable income or classify them as securities.

-

Dependency on Axie Infinity: Despite integrations, SLP’s health is still closely tied to Axie’s popularity.

Investor Tip: Don’t treat SLP as a long-term store of value. Instead, look at it like in-game fuel—valuable when there’s utility, worthless when ignored.

Final Thoughts

SLP’s comeback in 2025 is more than just a price bounce—it reflects a broader maturity in the Web3 gaming industry. The wild west days of Play-to-Earn may be over, but what’s emerging is a smarter, more player-focused ecosystem that balances fun with value.

SLP is at the heart of this transformation—adapting from a hyped token into a meaningful asset with utility across gameplay, crafting, and the wider blockchain economy.

Whether you’re a player, investor, or simply watching the crypto space evolve, SLP’s 2025 rebound is a reminder that in crypto, narratives can shift just as quickly as prices.