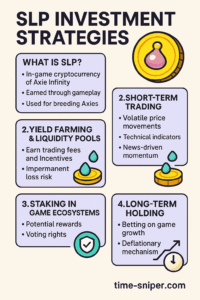

Smooth Love Potion (SLP) has carved a unique niche in the world of blockchain gaming. As the in-game currency for Axie Infinity, SLP plays a critical role in the game’s breeding mechanics and broader tokenomics. While many view SLP merely as a utility token, savvy investors are increasingly exploring SLPinvestment strategies to harness short-term gains or long-term returns.

In this guide, we’ll explore actionable strategies for investing in SLP, the associated risks, and how to maximize returns using data-backed insights. Disclaimer: This article is for educational purposes only and does not constitute financial advice.

What Is SLP and Why It Matters

Smooth Love Potion (SLP) is an ERC-20 token earned through gameplay in Axie Infinity. It is primarily used to breed new Axies, which introduces a dynamic supply-demand mechanism into the ecosystem.

SLP’s price is influenced by:

- Player activity

- Game updates and breeding fees

- Market speculation

- Burn rate versus mint rate

Understanding these fundamentals is key to building a robust SLP investment strategy.

1. Short-Term Trading: Capitalizing on Volatility

SLP is known for price volatility, driven by both crypto sentiment and in-game economics. Traders can utilize swing trading and technical indicators.

Strategies:

- Technical analysis: Use RSI, MACD, Bollinger Bands.

- News-based momentum: Follow Axie Infinity’s Twitter or Discord for update-driven price spikes.

- Volume confirmation: Monitor breakout candles with volume for trend validation.

Example: In mid-2021, SLP spiked over 100% after a breeding cost adjustment. Early traders benefited significantly.

Tip: Consider using centralized exchanges like Binance to reduce Ethereum gas fees during active trading.

2. Yield Farming & Liquidity Provision

Providing SLP liquidity on platforms like Katana (Ronin DEX), Uniswap, or SushiSwap can generate passive returns.

Pros:

- Earn trading fees

- Receive incentive tokens (AXS, RON)

Cons:

- Impermanent loss if SLP’s price diverges from the paired token

- Smart contract risks, so choose audited platforms

Monitor APR regularly and adjust based on your risk appetite.

3. Staking in Game Ecosystems

Although direct SLP staking is limited, the Ronin ecosystem is exploring future staking mechanisms.

Potential benefits:

- Governance participation

- Sustainable APRs if integrated into future updates

Keep track of ecosystem updates from Sky Mavis and Ronin.

4. Long-Term Holding: Bet on Game Growth

This strategy is based on the belief that Axie Infinity and play-to-earn (P2E) gaming will expand.

Why consider HODLing?

- Millions of active users globally (especially in emerging markets)

- Ongoing innovation (Axie Homeland, NFT staking)

- Deflationary potential if breeding demand increases

Checklist:

- Diversify (AXS, GMT, etc.)

- Use cold wallets for large holdings

- Review quarterly updates on tokenomics and user growth

Case: In 2021, long-term holders who bought SLP during dips and waited for rebounds achieved 30–50% returns.

5. Hybrid Strategy: Diversification by Design

Advanced users may opt for a blended approach:

Example allocation:

- 40% for swing trades

- 30% in yield farming

- 30% long-term hold

This method spreads risk while retaining growth exposure.

6. Risk Management: Navigate With Caution

SLP, like all crypto assets, involves inherent risks:

- Inflation risk: Minting outpaces burning

- Game lifecycle: Reduced player interest impacts token demand

- Regulatory uncertainty in various jurisdictions

Best practice: Limit SLP exposure to 5–10% of your crypto portfolio unless highly confident and active.

Conclusion

Investing in SLP requires understanding both the Axie ecosystem and broader crypto dynamics. Whether trading short-term, farming liquidity, or HODLing long-term, a well-informed, data-driven approach combined with proper risk management can turn this gaming token into a viable part of your investment portfolio.