In the ever-evolving world of digital assets, SLP—short for Smooth Love Potion—has emerged as a game-changer. Originally introduced as a utility token within the blockchain game Axie Infinity, SLP has grown beyond its in-game roots to influence trading strategies, tokenomics, and even the future of play-to-earn (P2E) economies.

As blockchain gaming becomes a pillar of the cryptocurrency ecosystem, understanding how SLP is reshaping the cryptocurrency landscape is essential for both casual investors and serious crypto analysts.

What Is SLP?

Smooth Love Potion (SLP) is an ERC-20 token created by Sky Mavis, the developer of Axie Infinity, one of the first successful blockchain-based games. Players earn SLP through gameplay and use it primarily to breed new Axie characters.

Unlike speculative cryptocurrencies that exist solely for trading or store-of-value purposes, SLP was born with utility. This makes it a unique case study in how real-use tokens can influence broader market behavior.

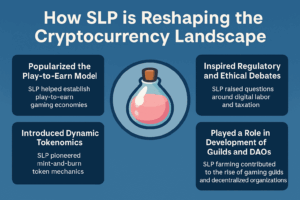

1. SLP Popularized the Play-to-Earn (P2E) Model

SLP is arguably the first token to sustain a full-fledged play-to-earn economy at global scale. During the 2020–2021 boom, Axie Infinity became a source of income for thousands of users—especially in developing nations such as the Philippines, Venezuela, and Indonesia.

Why It Matters:

-

It demonstrated how blockchain gaming could create real-world economic opportunities.

-

Unlike speculative tokens, SLP was earned through skill and time, making crypto accessible to non-investors.

-

It blurred the line between entertainment and financial participation.

Real-World Impact: At its peak, top players could earn $300–$600 per month in SLP, often exceeding local minimum wages. This drove explosive adoption and made SLP a financial lifeline for many.

Key Insight: SLP changed the narrative from “crypto as investment” to “crypto as livelihood.”

2. SLP Introduced Dynamic Supply and Demand Tokenomics

Most cryptocurrencies follow fixed supply models (like Bitcoin’s 21 million cap). SLP broke this mold with a mint-and-burn model:

-

SLP is minted by players through gameplay.

-

SLP is burned when players breed Axies.

This real-time supply/demand relationship made SLP one of the first tokens to operate like a commodity with inherent inflationary or deflationary pressures.

Economic Lessons from SLP:

-

During bull markets, breeding demand soared, leading to high burn rates and rising prices.

-

When player growth slowed, SLP supply ballooned, causing price crashes.

Example: In July 2021, SLP hit an all-time high of $0.36. By early 2022, oversupply issues pushed it below $0.01.

Takeaway: SLP taught the crypto world the importance of balanced in-game economies, influencing newer projects to build smarter token sinks.

3. SLP Inspired Regulatory and Ethical Debates

As Axie Infinity and SLP adoption spread, legal and ethical questions began to surface:

-

Is earning SLP through gameplay considered “labor”?

-

Should players report SLP earnings as taxable income?

-

Are scholars (players who rent Axies) being exploited?

Governments and scholars began taking notice. In some countries, authorities debated taxing SLP earnings, while NGOs questioned the ethics of digital labor.

Example: The Philippines’ tax bureau issued guidance indicating that SLP earnings should be reported under personal income.

Impact: SLP sparked broader discussions about the future of work, digital property rights, and crypto regulation in gaming.

4. SLP Played a Central Role in Developing Gaming Guilds and Web3 DAOs

The rise of SLP farming also gave birth to gaming guilds—organizations that lend out Axies to players in return for a share of SLP earnings. These guilds function like decentralized corporations, onboarding players, training them, and managing income distribution.

Major guilds such as Yield Guild Games (YGG) built entire business models around SLP.

Broader Influence:

-

DAO-style management: These guilds operated on blockchain principles, voting on SLP sharing rules and breeding strategies.

-

Scalable onboarding: Guilds enabled tens of thousands of players to participate without initial capital.

Case Study: At its peak, YGG reported tens of millions in monthly SLP-related revenues from its network of “scholars.”

Lesson: SLP drove Web3 gaming into organizational territory, shaping how DAOs function in high-volume microeconomies.

5. SLP Continues to Influence Token Design in New Projects

Today, SLP’s successes and failures are being studied by emerging projects in GameFi and metaverse sectors.

Key design principles inspired by SLP include:

-

Dynamic supply tied to in-game activity.

-

In-built deflation via utility (e.g., upgrading, breeding, crafting).

-

Stakeholder alignment between players, developers, and investors.

Example: Games like Illuvium, Big Time, and Guild of Guardians are incorporating lessons from SLP to prevent inflationary crises while encouraging real economic participation.

Conclusion: SLP’s legacy lives on in the architecture of newer, more sustainable blockchain gaming ecosystems.

Final Thoughts: SLP’s Enduring Legacy in Crypto

SLP may not be the most valuable token by market cap, but it’s one of the most impactful. It reshaped how the world views gaming, labor, and digital assets. From pioneering the P2E revolution to influencing how tokenomics are built, SLP’s role in the cryptocurrency landscape is undeniable.

As the Web3 world matures, the story of SLP serves as both a blueprint and a cautionary tale. It reminds us that sustainable design, community value, and balanced economics are key to long-term crypto success.

Whether you’re a developer, investor, or gamer, understanding SLP’s journey provides deep insights into where crypto is heading—and how blockchain can bridge entertainment with economic empowerment.